If you’re a small business and you hire no-employees to perform jobs, you most likely need to send out 1099 to those workers.

- What is a 1099 tax form?

- Who do I give a 1099 form?

- What is a 1096 Form?

- Who can help in submitting and filling the forms?

What is a 1099 tax form

A 1099 is an “information filing form”, used to report non-salary income to the IRS for federal tax purposes. 1099’s come in a variety of ways, but most individuals are aware of the 1099-MISC, which is the one we will be covering.

You will need to complete a 1099-MISC if you paid a independent contractor more than $600 in the calendar year.

Other 1099 forms cover income from dividends, prize winnings, credit card forgiveness, and/or multitude of other scenarios. They all have there own 1099 form, which will not be discussed here. Let’s go back and focus on the 1099-MISC form now.

1099-Misc Form: Who do I give a 1099 Form to:

File Form 1099-MISC for each person to whom you have paid during the year:

- At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- At least $600 in:

- Rents.

- Services performed by someone who is not your employee.

- Prizes and awards.

- Other income payments.

- Medical and health care payments.

- Crop insurance proceeds.

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

- Generally, the cash paid from a notional principal contract to an individual, partnership, or estate.

- Payments to an attorney.

- Any fishing boat proceeds.

In addition, use Form 1099-MISC to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

1096 Form

The 1096 Form is the Annual Summary and Transmittal of U.S. Information Returns. It is ONLY used if you are mailing the 1099 forms. If you electronically file, this form is not submitted.

Filing forms

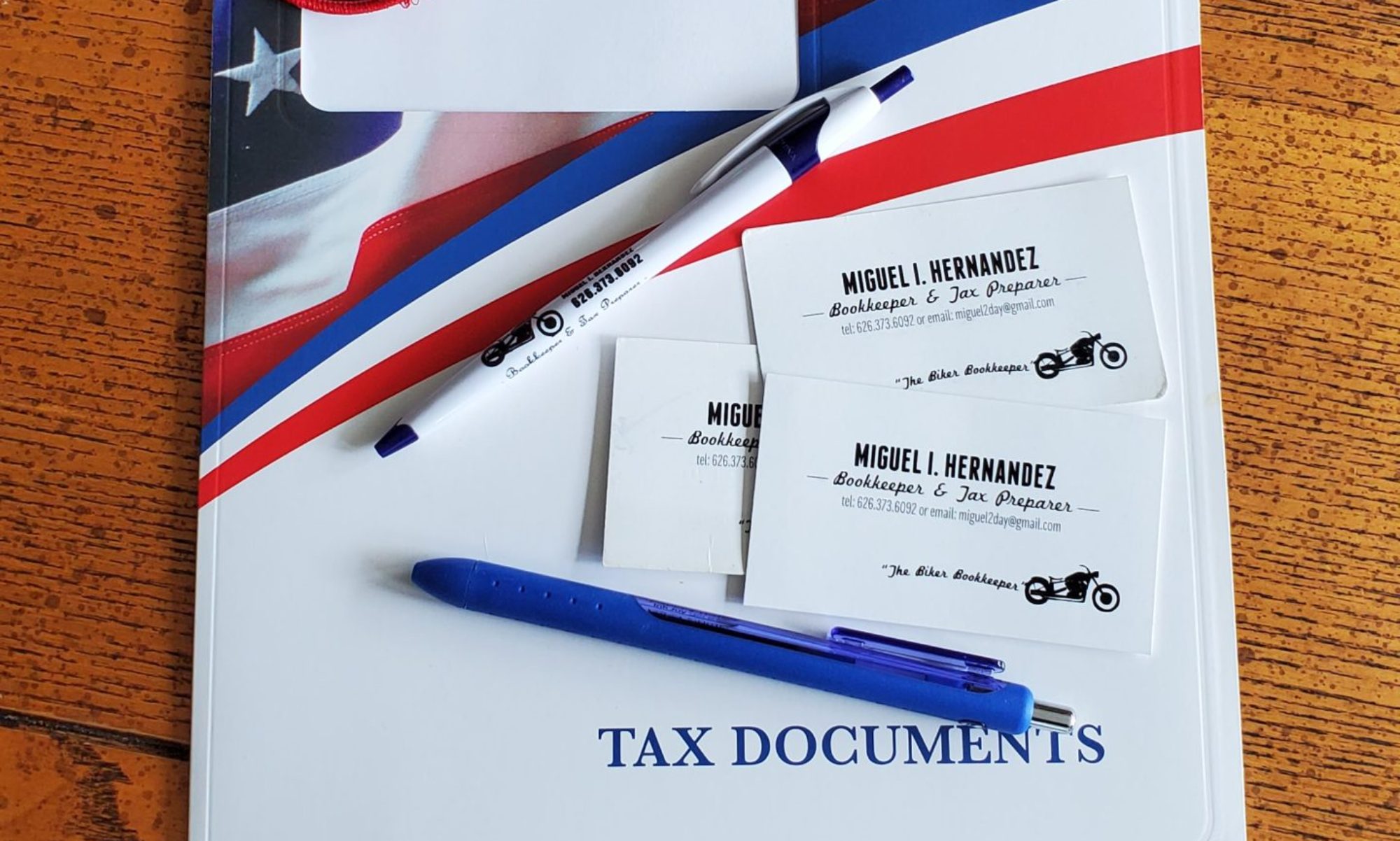

The forms are process by a bookkeeper/accountant or you can log on to the IRS and log the information yourself as well.